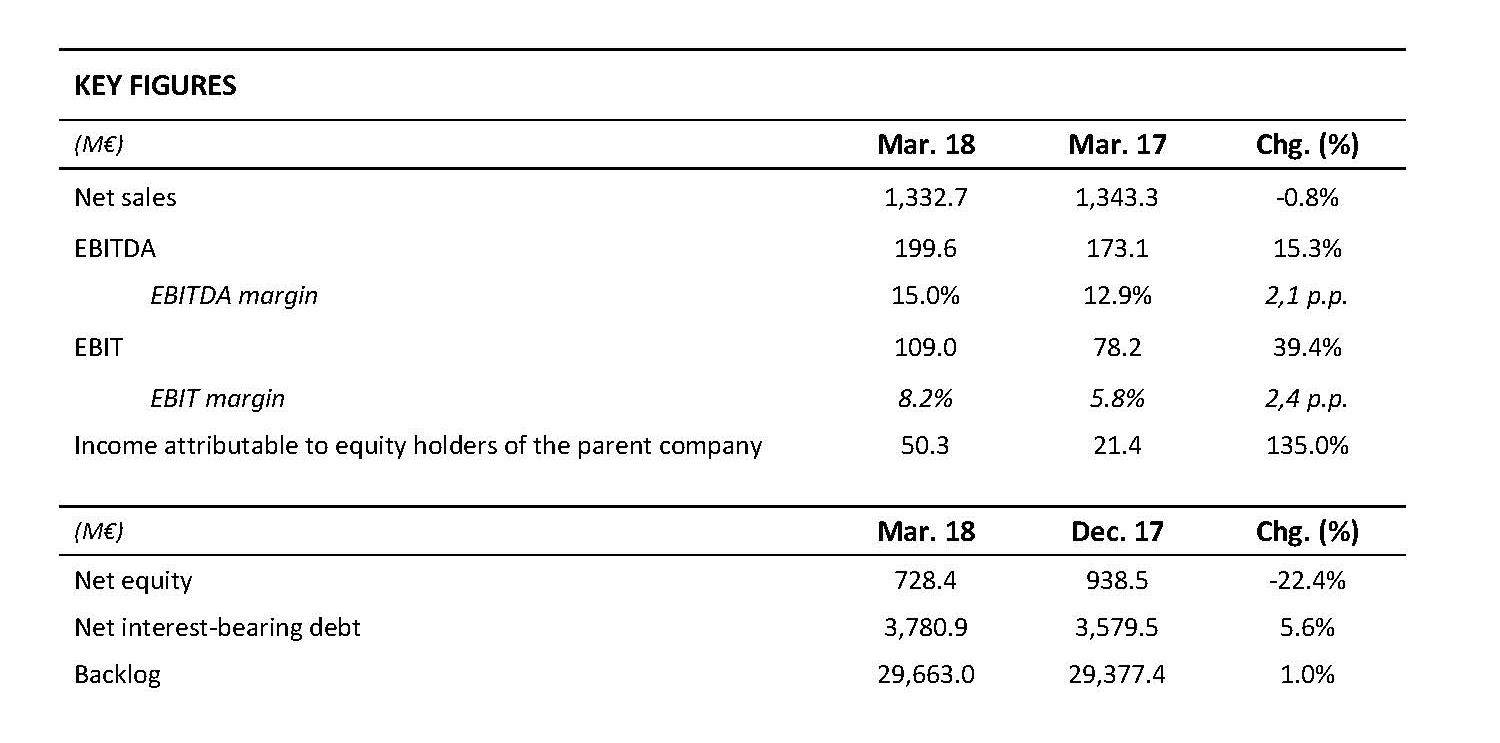

FCC's net attributable income improved notably in the first quarter of 2018 to €50.3 million

- FCC's EBITDA increased 15.3% to €199.6 million, compared with €173.1 the previous year

- EBIT amounted to €109 million (+39.4%)

- The FCC Group's backlog totalled €29,663 million, ensuring more than five years of activity

FCC's attributable net profit amounted to €50.3 million in the first quarter of 2018, a substantial increase on the €21.4 million reported in the first quarter of 2017.

The Group's EBITDA amounted to €199.6 million during the first quarter, a 15.3% increase. The EBITDA margin increased by 2.1 percentage points to 15%, a level never before attained at consolidated level by the FCC Group. These results also reflect ongoing efforts by the FCC Group to prioritise profitability by implementing efficiency measures, achieving synergies and enhancing productivity.

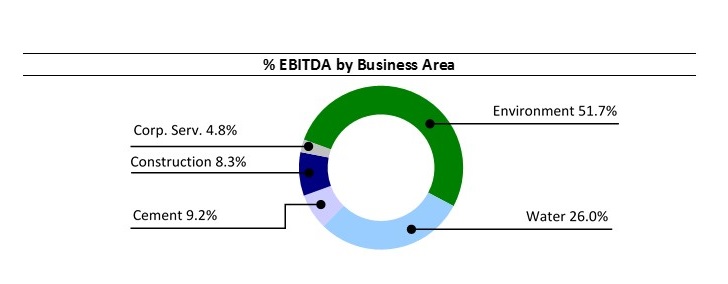

EBITDA performance by the Environmental Services business was outstanding, as it increased EBITDA by 11.4% to €103.2 million. The Cement division also performed strongly, with EBITDA up 35.9% to €18.4 million. The Water division reported €51.9 million, 1.4% more than in the year-ago quarter, and the Construction division increased EBITDA by 3.8% to €16.5 million.

EBIT amounted to €109 million, up 39.4% year-on-year.

Net financial expenses were cut by -29.7% in the period to €40.3 million. This sharp reduction was due to refinancing and financial optimisation measures applied during the previous year.

Group net interest-bearing debt stood at €3,780.9 million at the end of the first quarter, up 5.6% with respect to December 2017, due to the seasonal upswing in working capital that normally arises in the first half of the year and tends to revert in the second half.

t the end of the quarter, the Group's backlog totalled €29,663 million, ensuring more than five years of activity.

Milestones in the first quarter

FCC sold 49% of Aqualia to IFM for €1,024 million

In March, FCC agreed to sell a minority stake in FCC Aqualia, the parent company of its Water division, to IFM Global Infrastructure Fund. The main features of the transaction are as follows: (i) the FCC Group sold 49%; consequently, it retains control of the subsidiary. (ii) IFM is to pay €1,024 million for 49% of Aqualia, which implies that 100% of Aqualia is worth €2,090 million. (iii) Completion of the deal is subject to the usual conditions precedent (competition, authorisation from the financial authorities, etc.). (iv) The proceeds will be used mainly to pay down debt and, to a lesser extent, to cover other funding needs in the group. (v) FCC Aqualia, the head of the Water division, plans to maintain its current strategy, operations and commercial relations (with public administrations, private customers, suppliers, etc.), while strengthening and developing new markets, benefiting from the active involvement of its new shareholder, the resulting synergies, and the continuity of the company's current management.

FCC Construction obtains a contract in Ireland worth €220 million

The FCC Group's Construction division has obtained a contract to design and build two buildings on the Grangegorman campus of Dublin Institute of Technology (DIT). The project has a budget of €220 million and is to be completed in 26 months. It is being developed as a public-private partnership (P3), with Macquarie and the local company John Sisk&Son as concessionaires and clients of the construction company.

FCC Environment order intake reached €1,243 million in the first quarter

In the first quarter, the Environmental Services area obtained a number of municipal services contracts in Spain (notably Logroño and Gran Canaria), and recycling and waste recovery contracts in other countries, with the result that the backlog at the end of March was 5.5% higher than at 2017 year-end and amounted to €10,849.7 million, equivalent to four years' work on the basis of the revenue track record.

Aqualia obtains first contracts in Oman and Panama

In February, SAOC, a joint venture of Aqualia and Majis Industrial Services (owned by Oman Investment Fund), obtained a contract to develop, operate and maintain, for 20 years, all water-related services (capture, desalination, distribution and waste water treatment) in the Sohar port area, the most important district in northern Oman. Revenues over the contract term will amount to close to €120 million.

Panama's Ministry of Health has chosen Aqualia's proposal to design, build, operate and maintain the Arraiján Este waste water treatment plant. Worth €75 million, it is the Water division's first project in Panama.

In Mexico, this division is to design, outfit, construction and commission the Guaymas (Sonora) desalination plant and operate and maintain it over a total period of 20 years. The project represents a backlog of close to €110 million.

METHAmorphosis project picked as an example by the European Commission's LIFE programme

The European Commission highlighted METHAmorphosis, a project to obtain biomethane from municipal and agro-industrial waste, as an example in the report entitled "Two Years after Paris. Progress towards meeting the EU's climate commitments”.

The report analyses the degree of progress and effort of the EU countries in the commitment to reduce greenhouse gas emissions that was adopted at the Paris summit in 2015. This is a significant mention since METHA appears within the EU's five policies related to climate change and allows up to 70% energy savings in leachate treatment while reducing vehicles' carbon footprint by around 80% when compared with the use of fossil fuels.