FCC Group sees its EBITDA rise by 16.4% to 1.3114 billion euro in 2022

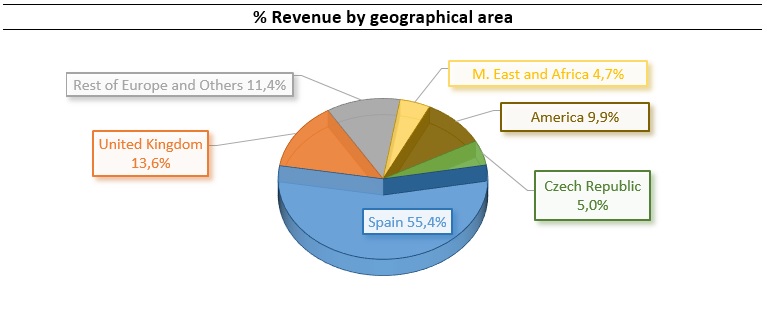

- Revenues stood at 7.7057 billion euro, 15.7% more than in 2021

- By the end of the year, the backlog had increased by 33.4% to 40.2738 billion euro

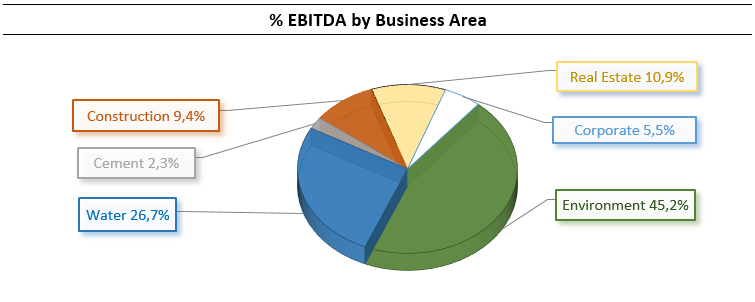

In the annual results for the 2022 financial year presented this morning by FCC Group, EBITDA (earnings before interest, taxes, depreciation and amortisation) stood out, having reached 1.3114 billion euro in 2022, an increase of 16.4% compared to the figure recorded for 2021. The positive performance across the Group's activities contributed to the rise in EBITDA, with increases in revenues and sustained and solid operating margins in the areas of Construction, Environment, Water and Real Estate, boosted by the various acquisitions carried out by the latter two.

The increase in the Group's activity has translated into revenues standing at 7.7057 billion euro, a 15.7% more than in 2021. The result reflects the double-digit growth in activity experienced by all business areas, among which Real Estate stands out with a growth of 83.1% in activity compared to the previous year.

EBIT (earnings before interest and taxes) decreased by 23.9% in 2022, standing at 610.5 million euro, due to the value adjustment made to the commercial fund in the Cement business area, reflecting the impact of higher energy costs. Adjusted for the extraordinary effects recorded in other operating income in both years, EBIT increased by 17.4% in 2022. The same effect is reflected in net income.

On 31 December, the net debt stood at 3.1927 billion euro, registering a slight reduction compared to the end of 2021. It should be noted that this result was obtained even with the aforementioned major acquisitions.

Equity amounted to 4.939 billion euro, 11.2% higher than in 2021.

At the end of the year, the contracted backlog amounted to 40.2738 billion euro, a 33.4% more than in 2021. Of note was the 65.4% growth in the Construction business area, and of 32.2% in that of Water. In both business areas, the contracts obtained internationally stand out as representing more than 64% of the total.

MILESTONES

The international orders for FCC Construction increase to over 2.7 billion euro

The following awarded contracts stand out:

Saudi Arabia FCC is leading a consortium to build the first tunnels for high-speed and freight railways, as well as the 28-kilometre-long subway in the new city of Neom, for a total of 775.2 million euro.

Norway FCC has been awarded the design and construction of the Sotra Link project as part of a consortium where the company holds a 35% stake. This project involves the construction of the RV 555 motorway, which will link the island of Sotra with the city of Bergen. This project forms part of the PPP Sotra Connection, the largest road infrastructure contract in Norway, with an overall budget of more than 1.23 billion euro, to be implemented as part of a public-private collaboration model. As at 31 December, the amount added to the backlog was 450.6 million euro.

Romania Two railway contracts for a combined amount of 580 million euro: the design and construction of the rehabilitation of section 3 Poieni-Alesd and the modernisation of the Caransebes-Timisoara-Arad route.

Mexico The business area signed an amendment to the construction contract for the Maya Train, adding a further 250 million euro to the value of the contract and adjusting the performance for the period.

Canada

- The consortium in which FCC Construction holds a 50% stake was chosen as the best bidder in the call for the construction of a suburban line in Toronto (RER-3). The contract includes the design, construction, operation and maintenance of a commuter rail network in the metropolitan area. The project has a total budget of more than 4 billion euro; the award and performance of the contract will be progressive, based on the agreement reached between the parties. The amount incorporated into the backlog by 31 December was 160 million euro.

- FCC was awarded (50%) of the Stations, Rail and Systems (SRS) contract for the Scarborough subway extension project, a municipality located in the eastern part of Toronto, for a total amount of around 1.8 billion euro. At 31 December, the amount incorporated into the backlog was 121 million euro.

United States. FCC Construction was awarded, as a member of a consortium, the Major Bridge P3 project in Pennsylvania, which consists of the design, construction, financing and maintenance of six bridges together with the connecting road and associated infrastructure. The total value of the contract is 1.5 billion euro. At the end of the year, 123.5 million euro had been incorporated into the backlog.

By the end of 2022, FCC Construction had increased its global backlog by 65% compared to 2021, exceeding a total of 4.7 billion euro.

FCC Environment increases its presence in the US with more than 1 billion euro in contracts in waste collection and treatment

The subsidiary of FCC Environment providing integrated urban waste management and recycling services in the US has been awarded several contracts:

Placer (California). Renovation and operation of a municipal solid waste (MSW) treatment environmental complex in Placer County, involving a portfolio of 1.5 billion dollars for a ten-year term and two possible five-year extensions. At 31 December, the registered backlog came to 595 million euro.

Port St Lucie (Florida). Contract for the residential collection of municipal wastes. The contract entails a backlog of more than 281 million euro for a seven-year term, with a possible extension of a further three years.

Palm Coast and Lake County (Florida). Award of the contract for the collection of MSW from these cities, for a combined amount of 146 million euro.

Hillsborough County (Florida). Waste collection for the remaining fraction of the county's public schools for the next three years.

In December, a new acquisition was made in the North American market with the purchase of Houston Waste Solutions (HWS), one of the largest commercial municipal solid waste companies in the Houston metropolitan area. HWS also owns and operates a construction and demolition waste transfer centre in the city. The company serves more than 3,000 customers.

FCC Environment remains a leader in the Spanish market, with new contracts worth more than 2.3 billion euro

In Spain, FCC Environment increased the size of its portfolio by more than 30%, as a result of several awards and renewals:

Zaragoza. Collection of urban solid waste (MSW) and street cleaning for more than 627 million euro for the next ten years.

Madrid. MSW contract for the west area of the city with revenues of 446 million euro.

Vigo. Waste management and street cleaning for the next ten years, extendable to twelve, for an amount of 380 million euro.

Salamanca. Renewal of the contract for street cleaning and waste collection, including the renovation and operation of the light packaging sorting plant in Salamanca, with a backlog of 236 million euros for the next twelve years.

Alicante. Award of the street cleaning and MSW contract (in joint venture) for the next eight years for 196 million euro.

Girona. Renewal of the city's urban sanitation contract for eight years and 107 million euro.

Badajoz. Eight-year extension of the contract for street cleaning and waste collection, amounting to 94 million euro.

Mijas (Malaga). Contract for street cleaning services and MSW, for ten years, worth 80 million euro.

Granollers (Barcelona). Waste collection and street cleaning for ten years and 47 million euro.

Tenerife. The joint venture in which FCC Environment holds a 29% interest was awarded the contract for the management of the waste complex in Tenerife, for an amount of 107.7 million euro and with a contract term of fifteen years, extendable for a further four years.

Aqualia is awarded new contracts in Saudi Arabia and expands its international end-to-end water cycle management platform

Saudi Arabia. Aqualia has been awarded two new management, operation and maintenance (MOM) contracts for the South Cluster and North Cluster in the months of February and September, respectively. The contracts (two of the six awarded for each of the clusters into which the country has been divided) are for seven years; the total population served is around eight million people and the combined associated backlog amounts to 196 million euro.

Colombia. Aqualia acquired 100% of the assets of Saur Colombia SAS, including six concessionary companies responsible for the production and distribution of drinking water and sewage in eleven towns across three regions on the northern coast of Colombia. Together, the various acquisitions undertaken in relation to the country's water cycle management amounted to 24 million euro.

Georgia. Aqualia acquired 80% of the water business area of Georgia Global Utilities JSC (GGU), the owner and operator of the water cycle infrastructures in Tbilisi, Mtskheta and Rustavi, Georgia, with an incorporated income backlog of 3.589 billion at year-end.

FCC Concessions acquires 100% of the Murcia tram for 48.5 million euro

Last November, FCC Concessions completed the buy-out of the remaining 50% of Sociedad Concesionaria Tranvía de Murcia for 48.5 million euro. The company holds the management contract for the only tram line in the city for a period of 40 years, providing regular transport under a municipal concession. Its V-shaped structure is eighteen kilometres long and connects the northern area of Murcia (universities, department stores and residential areas) with the city centre.

The Real Estate business area steps up its development potential acquiring a share in Metrovacesa

On 24 April, FCC Real Estate launched a partial takeover bid for 24% of the capital in Metrovacesa; following this transaction, and based on the results published by the stock market regulator on 21 June, this saw the company's share in Metrovacesa rise to an 11.47%.

Subsequently, last December, Metrovacesa distributed a flexible dividend, after which, according to the latest communication sent to the National Securities Market Commission (CNMV), FCC Real Estate owns 14.3% of the company.

| KEY FIGURES | |||

| (Millions of euros) | Dec. 22 | Dec. 21 | Chg. (%) |

| Revenue | 7,705.7 | 6,659.3 | 15.7% |

| Gross Operating Profit (EBITDA) | 1,311.4 | 1,126.6 | 16.4% |

| EBITDA Margin | 17.0% | 16.9% | 0.1 p.p |

| Net Operating Profit (EBIT) | 610.5 | 802.2 | -23.9% |

| EBIT Margin | 7.9% | 12.0% | -4.1 p.p |

| Income attributable to the parent company | 315.2 | 580.1 | -45.7% |

| Equity | 4,939.0 | 4,440.7 | 11.2% |

| Net financial debt | 3,192.7 | 3,225.7 | -1.0% |

| Backlog | 40,273.8 | 30,196.9 | 32.4% |